| The Accounting Technician Scheme West Africa has its subscription fees paid annually by students as well as examination fees. After induction, you will pay a certain fee every year for as long as you are holding the certificate. Below is the breakdown of each fee you are expected to pay for the ICAN/ATS program |

- Registeration fee: NGN 6,000.

- Development fee: NGN2,000

- Subscription fee: NGN 4,000

The registration and development fees are paid once. However, the subscription fee is paid yearly till you complete the three levels of exams for ATSWA. After induction, the fee structure changed. I don’t have the current fee. When I do, I will communicate it here.

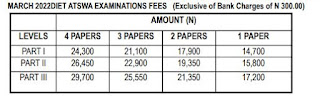

Examination fee for ATSWA

Part 1:

- Four papers: NGN24,300

- Three papers: NGN21,100

- Two papers: NGN17,900

- One paper: NGN14,700

Part 2:

- Four papers: NGN26,450

- Three papers: NGN22,900

- Two papers: NGN19,359

- One paper: NGN15,800

Part 3:

- Four papers: NGN29,700

- Three papers: NGN25,550

- Two papers: NGN21,350

- One paper: NGN17,200

Final word

The ICAN-ATSWA fee structure is listed above. All you need to do is to estimate the cost of writing all three levels of exams. To reduce cost, you need to work smart so that you won’t pay for a level twice. What I mean here is that, if you fail a particular level paper, you will have to resit that paper. For example, if a student fails two papers in ATS one, he or she will pay NGN17,900 to rewrite the examination. That is after paying NGN24,300 to write it for the first time. Costs a total of NGN42,200.